• State Pension: Provided by the government once you reach State Pension age, based on your National Insurance contributions.

• Private Pensions: These include pensions through work (called workplace pensions) or ones you set up yourself (personal pensions). You and/or your employer pay into them over time.

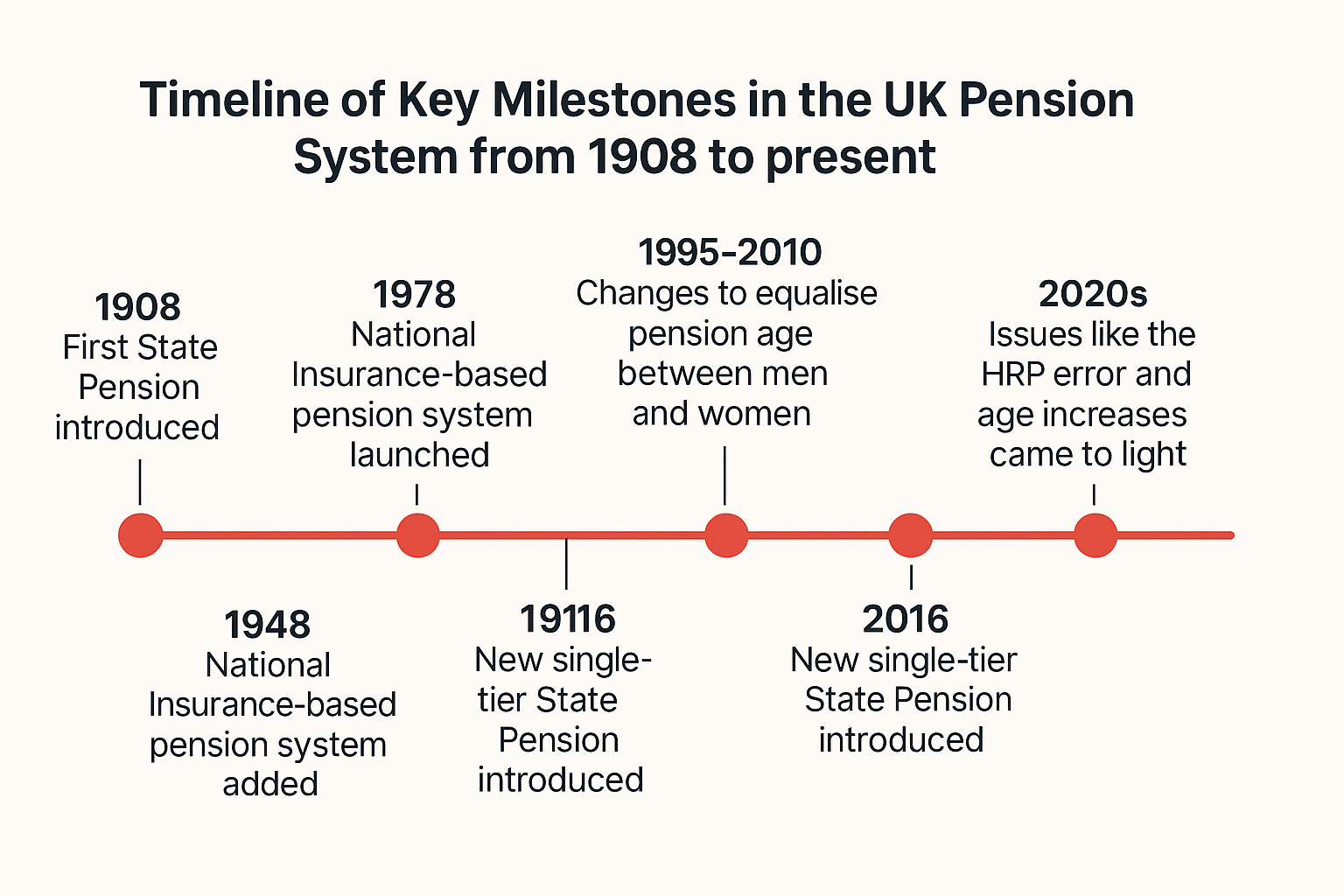

• 1908 – First State Pension introduced

• 1948 – National Insurance-based pension system launched

• 1978 – SERPS (State Earnings-Related Pension Scheme) added extra pension based on earnings

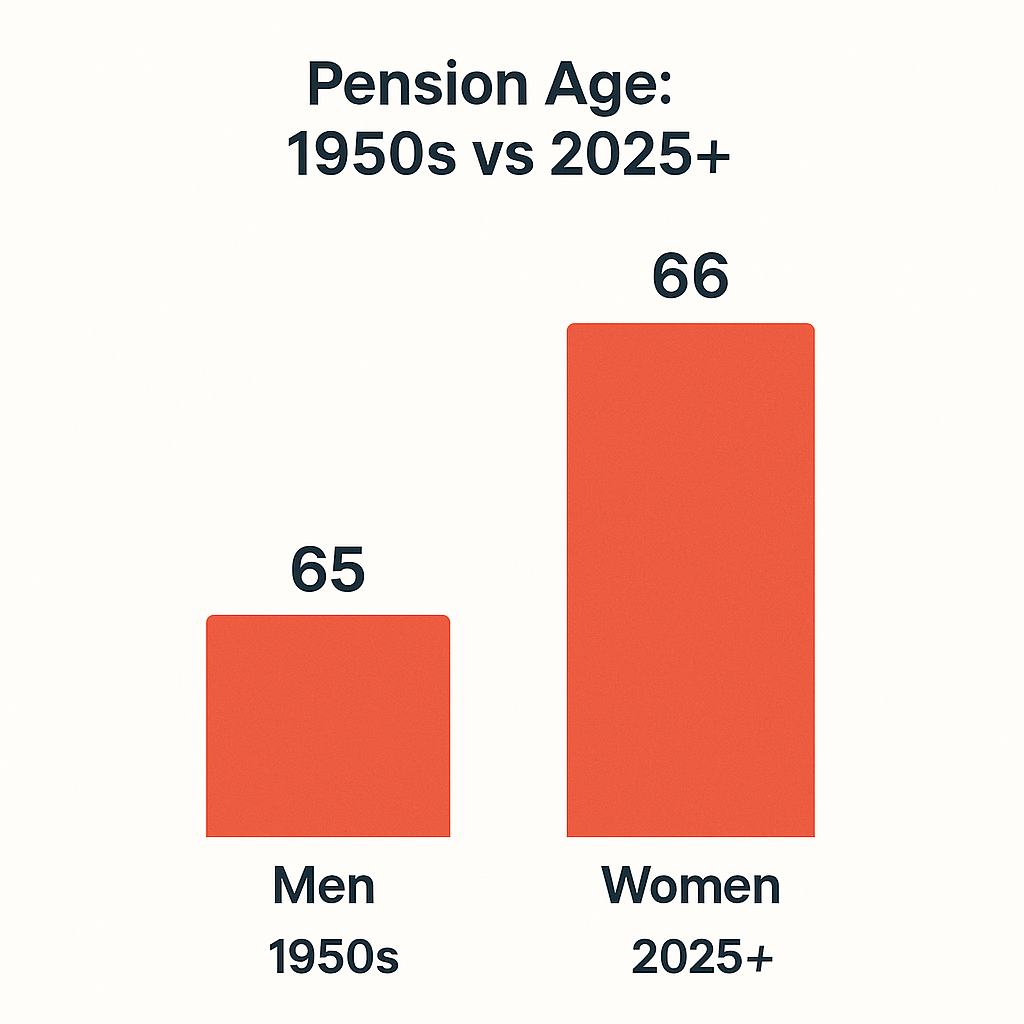

• 1995–2010 – Changes to equalise pension age between men and women

• 2016 – New single-tier State Pension introduced

• 2020s – Issues like the HRP error and age increases came to light

In 1948, the weekly State Pension was just £1.30 for a single person. By today’s standards, that may seem low, but it was a start. Today, the full new State Pension is over £200 per week, though the exact amount depends on your record.

The Home Responsibilities Protection (HRP) scheme was introduced to protect people (mostly women) who stayed home to care for children or relatives. However, due to a technical error, some National Insurance records weren’t updated correctly. This means some people may not be getting the full pension they’re owed.

You can check if you’re affected by visiting the official GOV.UK website.

• Defined Benefit Pensions: Often from older workplace schemes, paying a guaranteed amount based on your salary and years worked.

• Defined Contribution Pensions: Built up through regular contributions, with the final amount depending on how much was paid in and investment performance.

Want to know what you might receive? Use the State Pension forecast tool at gov.uk. You can:

• See how much you might get

• Check when you’ll reach pension age

• Find out if you have any National Insurance gaps

When did the UK start old age pensions?

1908, with the Old Age Pensions Act.

How much was the pension in 1948?

£1.30 per week for a single person.

Who introduced the State Pension?

Prime Minister H. H. Asquith’s government passed the 1908 Act.

What was the pension age in 1950?

65 for men, 60 for women.

How do I know if the HRP error affects me?

Check your National Insurance record at gov.uk or contact HMRC.

• Further increases to State Pension age

• The future of the triple lock (which helps pensions rise with inflation or wages)

• Discussions about whether pensions might be means-tested in future

Ready to review your pension plan or set up a private pension that aligns with your values? Explore Zomi Wealth’s expert-led pension planning service and take the first step toward a retirement that reflects your goals.

Subscribe to our newsletter for exclusive tips, expert advice, and the latest updates from Zomi Wealth—delivered straight to your inbox.

Know more about Zomi Wealth, how we invest, our plans and how to be a part of Zomi Wealth. Contact Us!