• Company earnings

• Economic indicators

• Interest rates

• Political events

• Global news

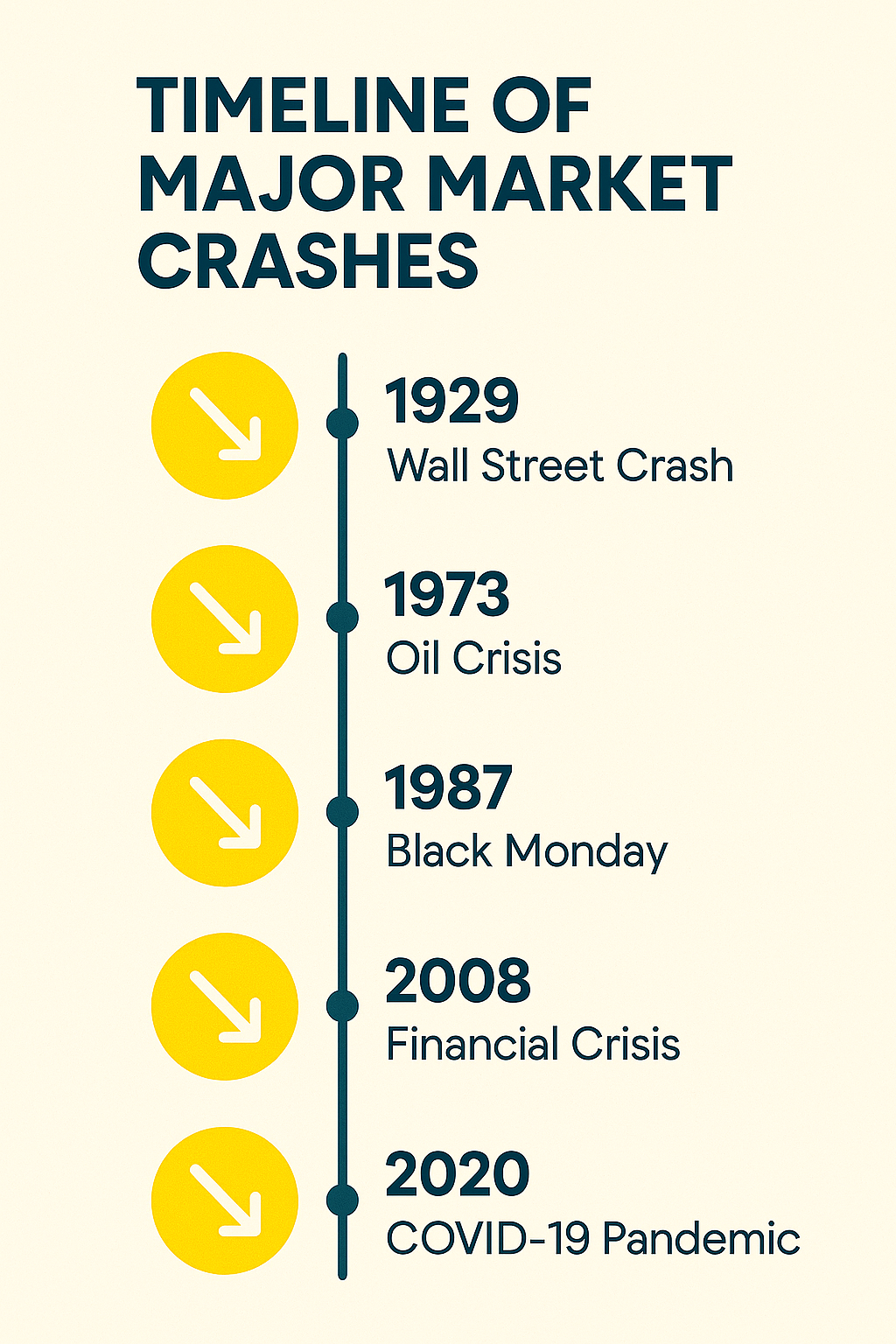

Dotcom Bubble (2000–2002): Tech stock collapse

2008 Financial Crisis: Triggered by the US housing market crash

COVID-19 (2020): Sudden drop due to pandemic uncertainty

• FTSE 100 – Top UK firms

• DJIA – 30 leading US companies

• S&P 500 – Broader US market

• Nikkei 225 – Japan’s top stocks

When did the stock market begin?

The Amsterdam Stock Exchange, founded in 1602, is considered the first formal stock market.

What is a stock market crash?

A crash is a sudden and dramatic drop in share prices, often caused by panic or economic shifts.

What caused the 1929 stock market crash?

Over-speculation, poor regulation and mass borrowing were key factors.

What was the highest stock market level ever recorded?

The Dow Jones Industrial Average (DJIA) reached an all-time high of 40,077 in May 2024.

How do today’s markets compare to historical ones?

Today’s markets are faster, more regulated, and digitally accessible, but still susceptible to global risks.

Want to Learn More About the Markets?

Sign up for market updates from providers authorised by Financial Conduct Authority (FCA)

Track indices like the Financial Times Stock Exchange 100 Index (FTSE 100) and Dow Jones Industrial Average (DJIA)

Use educational tools to expand your knowledge—no trading required

• Compare ISA providers authorised by Financial Conduct Authority (FCA)

• Understand fee structures

• Read all terms and conditions before opening or transferring accounts

• Authorised and regulated by Financial Conduct Authority (FCA)

• Transparent fee structure

• Tools and education for all experience levels

• No financial advice, just information to help you make informed decisions

Subscribe to our newsletter for exclusive tips, expert advice, and the latest updates from Zomi Wealth—delivered straight to your inbox.

Know more about Zomi Wealth, how we invest, our plans and how to be a part of Zomi Wealth. Contact Us!