• Save £200/month for a home deposit by December 2025.

• Pay off £1,000 of credit card debt in 6 months.

Use digital goal-setting apps or a simple spreadsheet to keep on track.

• 50% on needs

• 30% on wants

• 20% on savings/debt

• Check your accounts weekly

• Use cash envelopes to limit spending

• Celebrate small savings wins

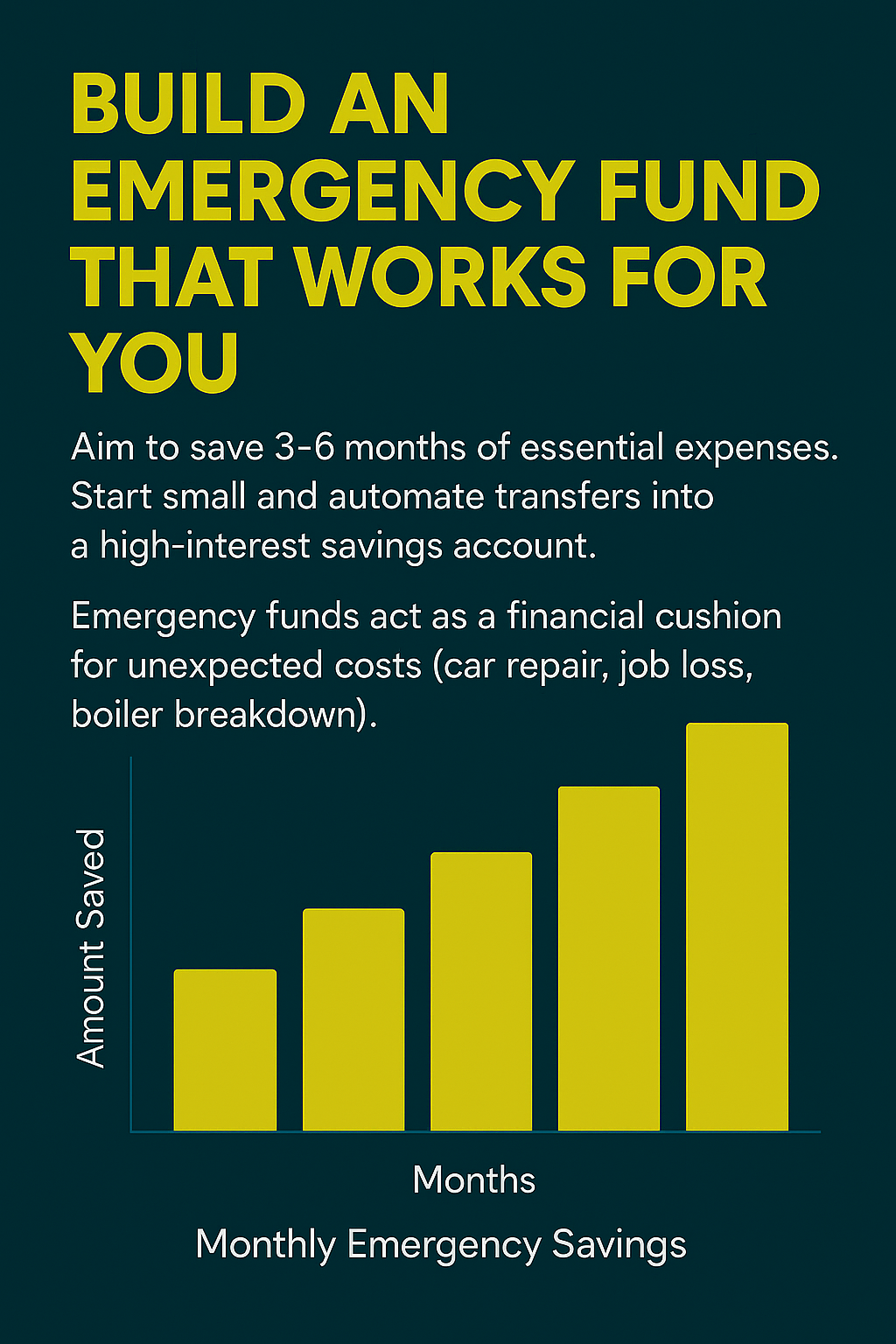

How much emergency fund should I have?

Ideally, 3–6 months of necessary expenses. If you’re freelance or have dependents, consider saving more.

What is a SMART financial goal example for 2025?

“I will save £2,000 for an emergency fund by setting aside £167/month for the next 12 months.”

How do I start saving money every month?

Set up a standing order the day after payday. Treat savings like a fixed bill.

What’s a simple budgeting rule I can follow?

The 50/30/20 rule is effective: 50% needs, 30% wants, 20% savings.

How can I avoid financial scams in the UK?

Check for FCA authorisation, ignore unsolicited emails or texts, and never give PINs or login info.

How much should I be saving each month?

Aim for at least 20% of your income. If that’s too much, start with 5% and build up.

Subscribe to our newsletter for exclusive tips, expert advice, and the latest updates from Zomi Wealth—delivered straight to your inbox.

Know more about Zomi Wealth, how we invest, our plans and how to be a part of Zomi Wealth. Contact Us!