• Fixed Costs: Rent/mortgage, utilities, insurance

• Flexible Costs: Groceries, fuel, activities

• Savings Goals: Emergency fund, child trust fund

• Reduce Grocery Bills: Use meal plans, buy in bulk, avoid shopping when hungry

• Buy Second-hand: From prams to clothing, online marketplaces can help save money

• Teach Kids About Money: Involving children in small saving activities instils long-term habits

• Consider costs for maternity/paternity leave

• Save for baby essentials: pram, cot, clothes, feeding supplies

• Plan for loss of income during early months

• Adjust your budget monthly

• Factor in changing needs: formula, nappies, healthcare

• Rebuild your emergency fund as needed

• Review your finances monthly

• Set goals with your partner and children

• Speak to Zomi advisers for wealth management in UK

How much does it cost to raise a child in the UK?

It depends on location and lifestyle. Some estimates put the cost at over £150,000 from birth to 18.

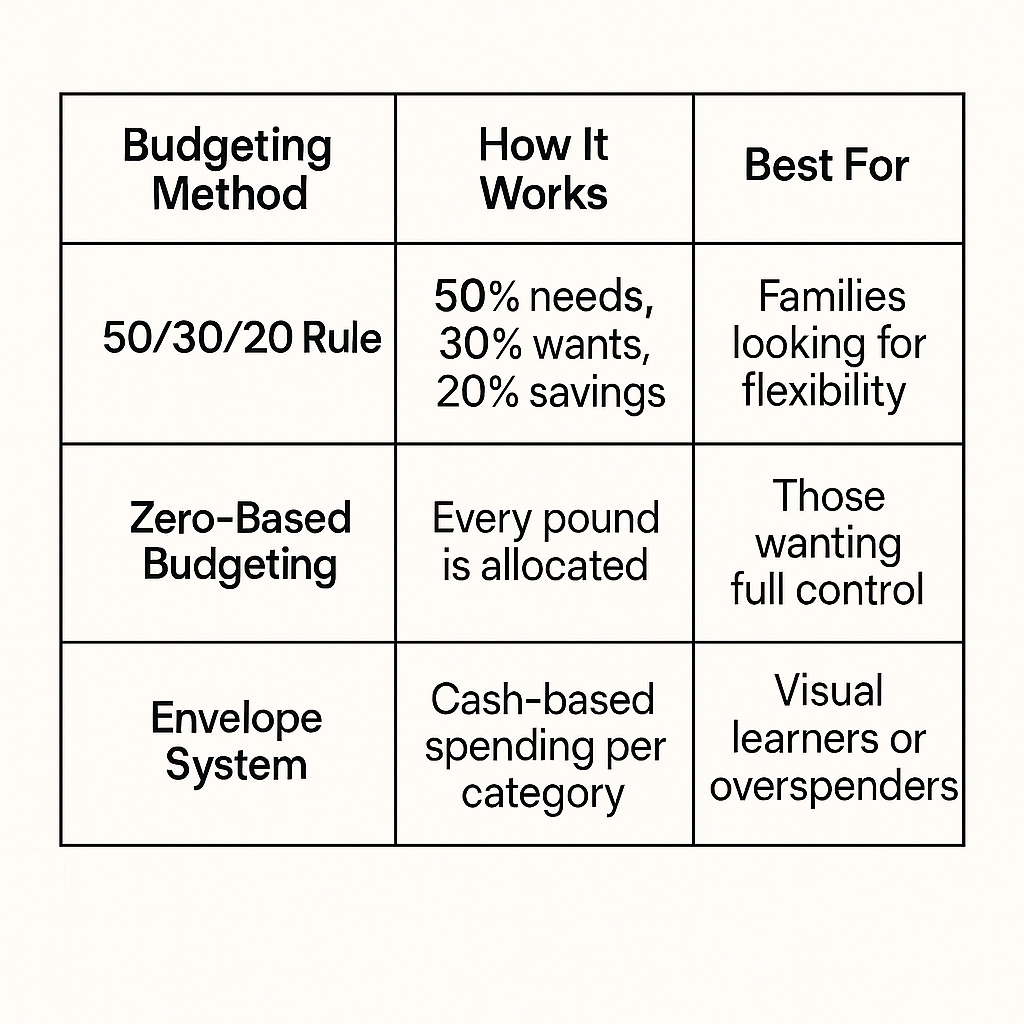

What’s the best budgeting system for families?

Many prefer the 50/30/20 rule for its balance, but zero-based budgeting offers more control.

How do I make a will in the UK?

You can use online templates or work with a solicitor. Costs range from £100 to £300, depending on complexity.

How can we involve children in budgeting?

Use pocket money to teach saving/spending balance or create a family savings goal chart.

Are budgeting apps safe to use?

Most major apps use bank-level encryption. Always check FCA authorisation before connecting your accounts.

Looking to take control of your family’s finances? Our expert advisers are here to help you understand your options, manage your money, and build financial confidence.

Start today! Talk to an adviser at Zomi Wealth and take the first step towards better family finances.

Subscribe to our newsletter for exclusive tips, expert advice, and the latest updates from Zomi Wealth—delivered straight to your inbox.

Know more about Zomi Wealth, how we invest, our plans and how to be a part of Zomi Wealth. Contact Us!