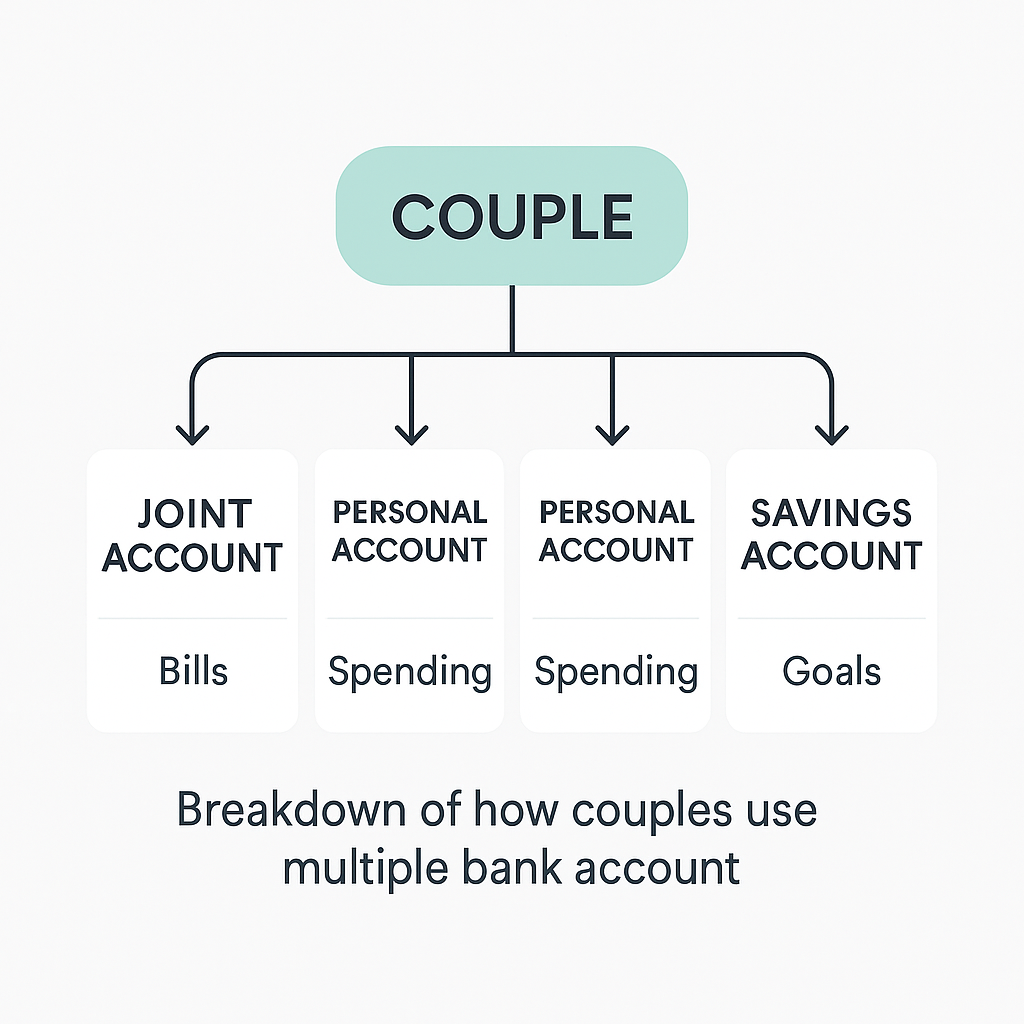

• Income management: Keeping income in one account and transferring amounts to others for specific purposes

• Household bills: Joint accounts can be used to pay recurring expenses such as rent, utilities, and subscriptions

• Savings: Separate accounts may be opened for goals like holidays, weddings, or emergency funds

• Personal spending: Individual accounts can help each partner maintain financial independence

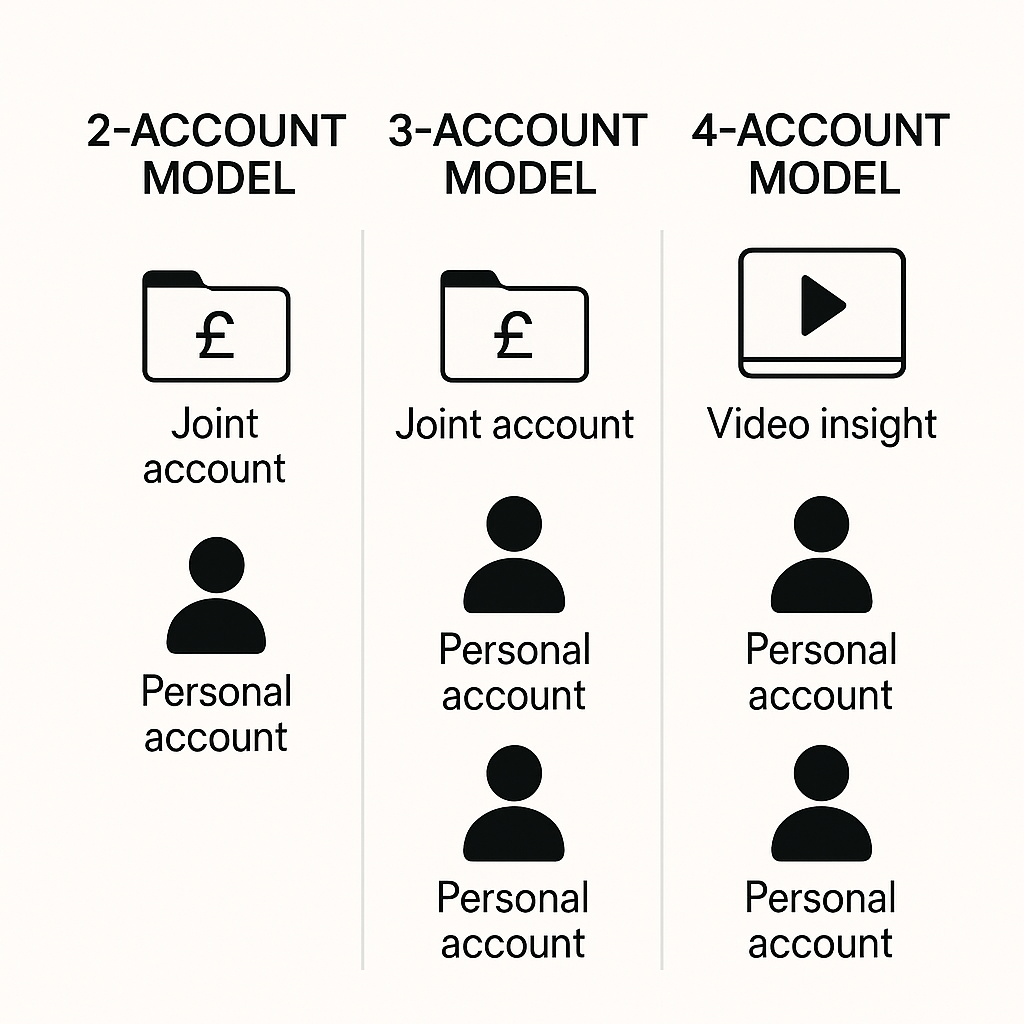

• Two-account model: One joint account for bills, one personal account for each partner

• Three-account model: Each partner has a personal account and shares a joint account

• Four-account model: Accounts designated for joint expenses, joint savings, individual spending, and one for shared goals or discretionary items

You can find more on this topic at FCA or MoneyHelper.

• Couples saving for holidays may set up a travel-specific account

• New parents might open a baby expenses account

• Freelancers or gig workers may benefit from accounts for income, tax, and personal spending

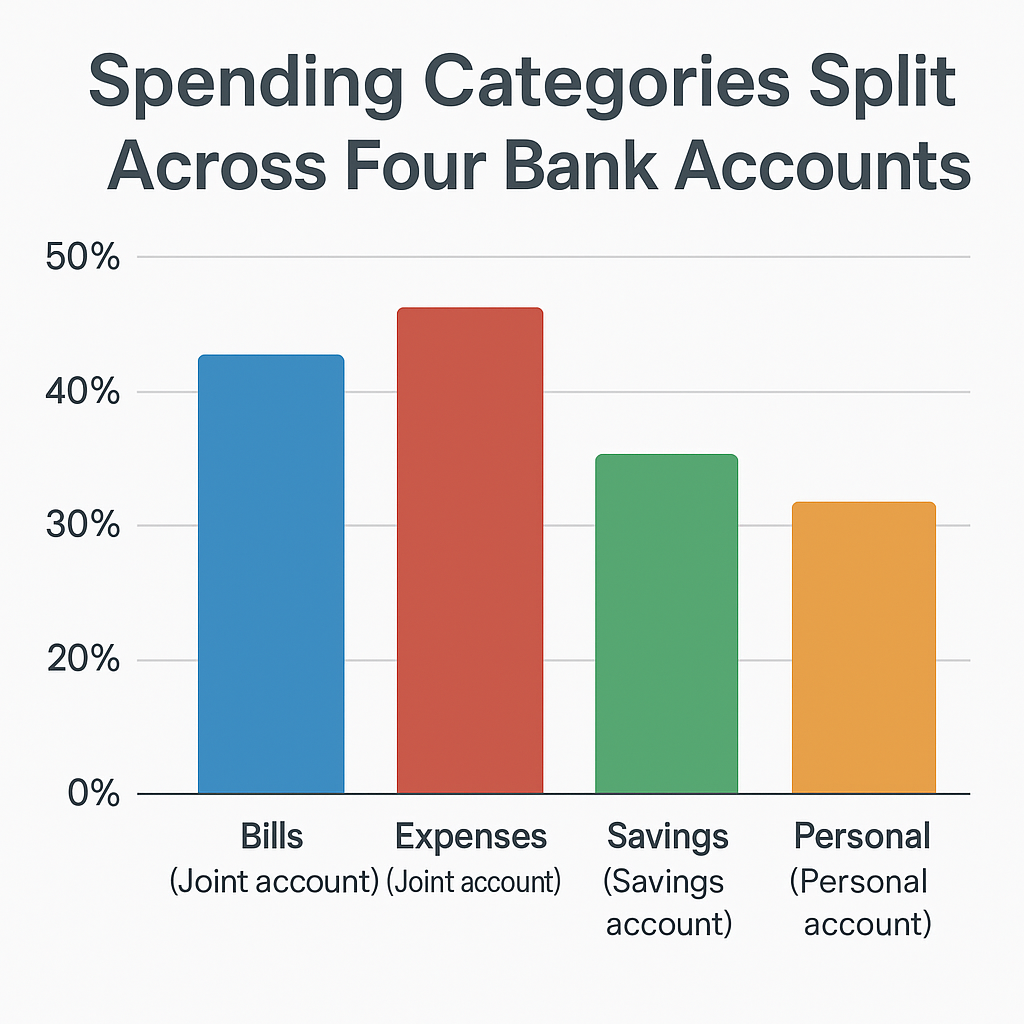

Why would someone have four bank accounts?

To manage income, joint expenses, personal spending, and savings in separate spaces for better clarity.

How many bank accounts should a married couple have?

There’s no standard number. It depends on how each couple prefers to manage money.

What is the point of having multiple bank accounts?

It can help compartmentalise finances, making it easier to track, plan, and stay accountable.

Is it illegal to have four bank accounts?

No. UK residents can have as many as they wish, subject to the bank’s requirements.

Subscribe to our newsletter for exclusive tips, expert advice, and the latest updates from Zomi Wealth—delivered straight to your inbox.

Know more about Zomi Wealth, how we invest, our plans and how to be a part of Zomi Wealth. Contact Us!