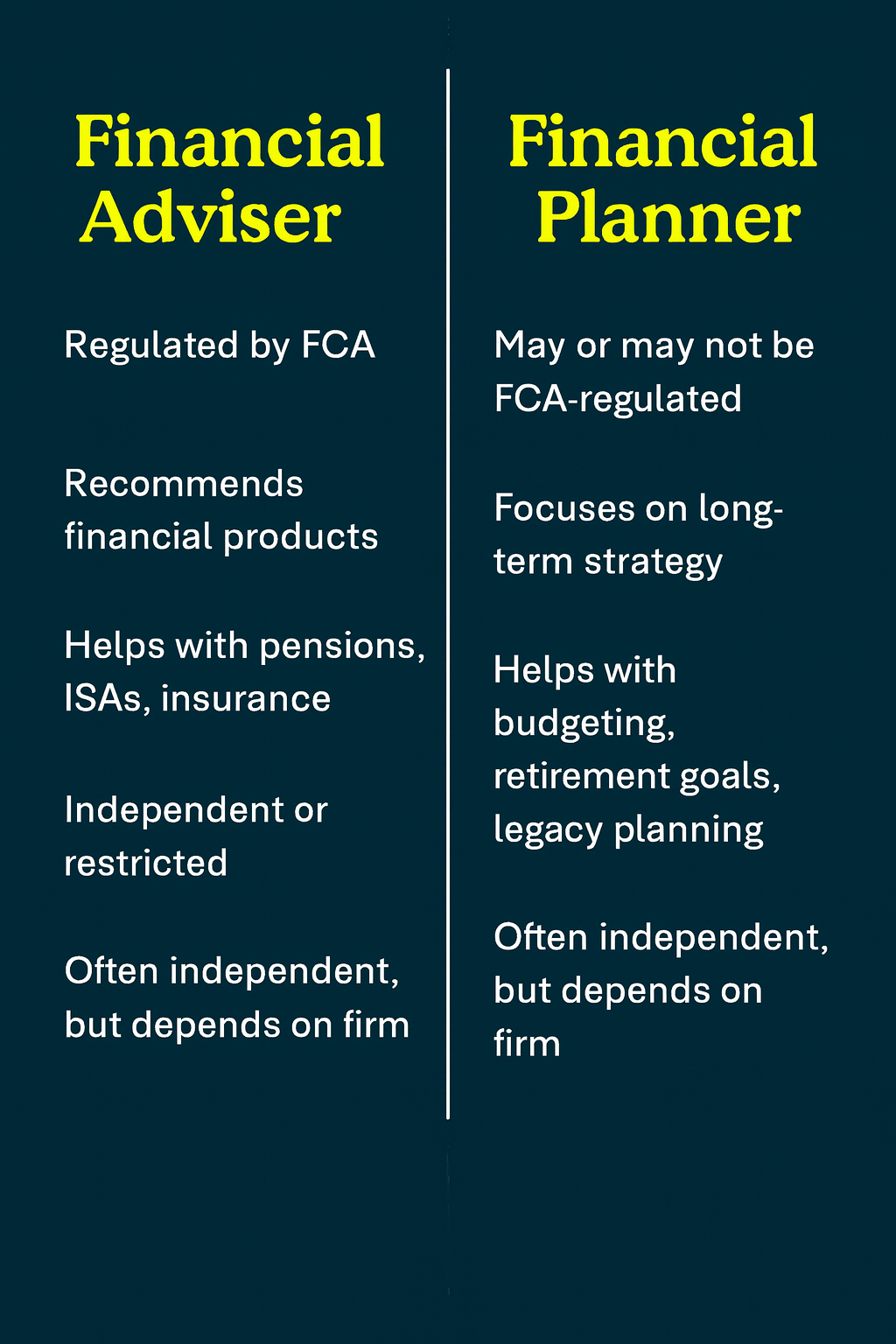

• Independent – offering advice on a range of products from the whole market

• Restricted – limited to specific providers or product types

• If you are looking to buy or change a financial product (e.g. pension fund, ISA, life insurance), you must speak to a regulated financial adviser

• If you want a big-picture strategy, such as how to retire early or pass on wealth tax-efficiently, a planner may be more appropriate

• Set retirement savings goals

• Plan for future care or education costs

• Structure inheritance or estate plans

• Use scenario modelling to project long-term outcomes

• Not all planners are FCA-regulated, so they cannot give product advice unless authorised

• Costs vary, and services may include upfront planning fees or ongoing retainers

• Quality differs, so it’s essential to verify credentials such as CISI or CII qualifications

• Inheriting a lump sum

• Planning pension drawdown

• Choosing between investment products

• A fixed one-off fee

• An hourly rate

• A percentage of assets under management

• Advisers who earn through commissions or performance-linked structures may earn more, especially in large firms or banks

• Planners in salaried roles may have more stable but modest incomes

Subscribe to our newsletter for exclusive tips, expert advice, and the latest updates from Zomi Wealth—delivered straight to your inbox.

Know more about Zomi Wealth, how we invest, our plans and how to be a part of Zomi Wealth. Contact Us!