1. Better budgeting: Know how much to spend vs save

2. Avoiding debt traps: Understand interest, credit, and borrowing risks

3. Saving and investing earlier: Build wealth from a younger age

4. Reduced stress: Feel in control of finances, even during tough months

• Don’t know how to create a realistic budget

• Fail to grasp how credit card interest works

• Lack the habit of saving regularly

• Confuse “good debt” (e.g. student loans) with harmful high-interest borrowing

1. Start a Simple Budget

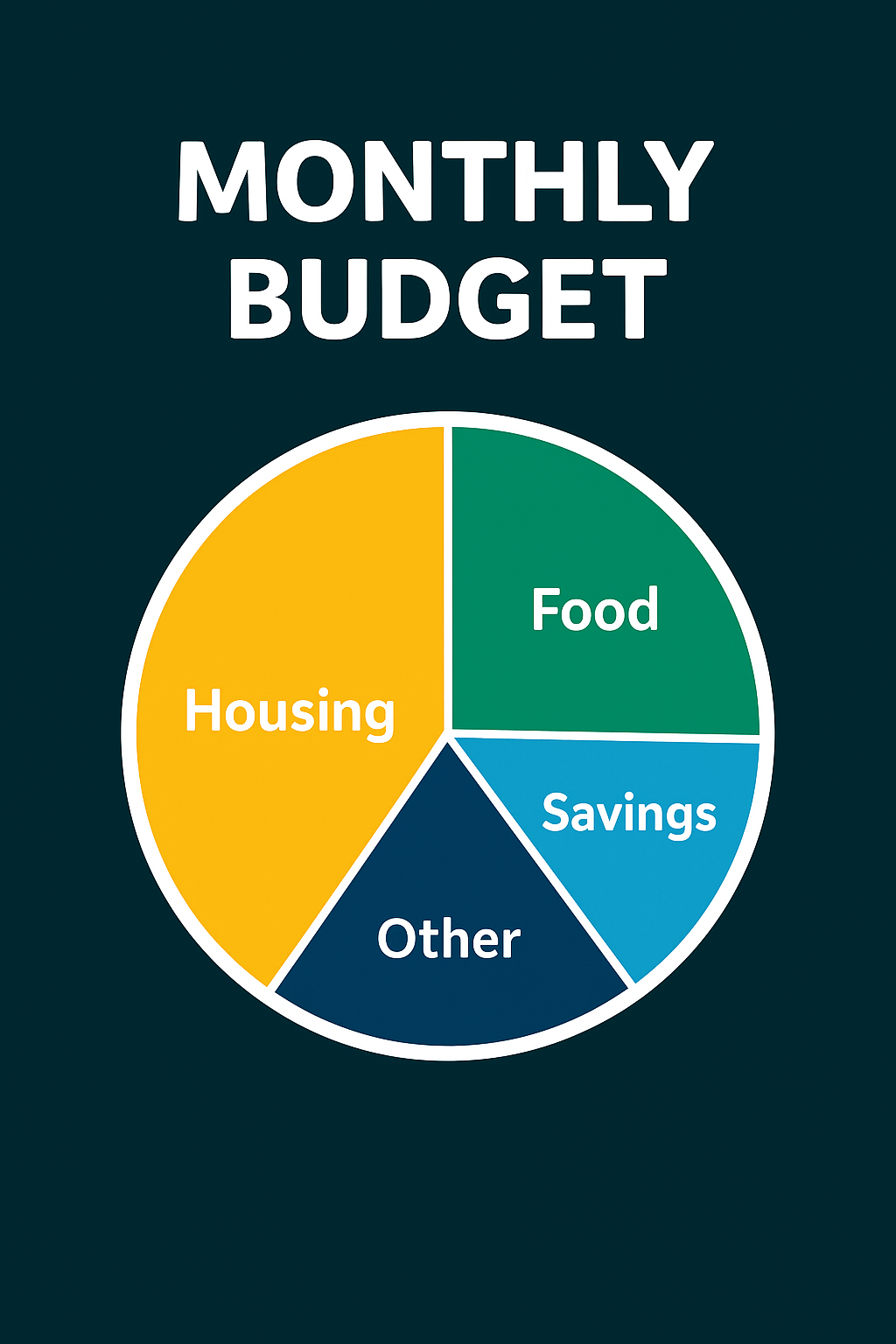

Try the 50/30/20 rule (needs/wants/savings).

2. Use Free UK Financial Resources

Visit MoneyHelper for guides, calculators, and budgeting templates.

3. Build a “Freedom Fund”

Set aside even £20 a month to start. Having an emergency fund reduces stress during unexpected expenses.

4. Learn About Credit

Check your credit score. Understand how APR works and always aim to pay off credit cards in full.

5. Explore Basic Investing

Understand how ISAs, compound interest, and pensions work. You don’t need to invest right away, just start learning.

6. Seek Support When Needed

Don’t try to do it all alone. For one-on-one guidance, speak with a trusted adviser.

Get in touch with our financial advisers for help with budgeting, saving, or investing wisely.

Budgeting struggles are not about failure, they’re often about a lack of knowledge.

Once you understand what you were never taught, you can take control of your finances today. Learn. Budget. Save. Ask for help when needed.

With the right tools and habits, financial confidence is just a few steps away.

Get in touch with our financial advisers for one-on-one budgeting and financial guidance tailored to your life.

Subscribe to our newsletter for exclusive tips, expert advice, and the latest updates from Zomi Wealth—delivered straight to your inbox.

Know more about Zomi Wealth, how we invest, our plans and how to be a part of Zomi Wealth. Contact Us!