The new tax year has arrived, and while there are few headline-grabbing changes, the freeze on many key thresholds means more people will quietly pay extra tax. For retirees and those nearing retirement, it’s a good moment to step back, review your income sources, and make sure your tax planning is as efficient as possible.

At Zomi Wealth, we’ve put together this easy-to-read summary of what’s changing for 2025/26, and how a few simple steps can help you keep more of your hard-earned money.

Your Personal Allowance – the amount you can earn before paying income tax, remains at £12,570. This has been frozen since 2021 and will stay that way until at least April 2028. That might not sound dramatic, but it means more of your pension income and savings interest could slip into higher tax brackets over time.

Here are the income tax bands for the 2025/26 tax year:

If you’re receiving the State Pension, remember it counts as taxable income — even though no tax is taken from the payment itself.

Tip: If you and your spouse or civil partner have unequal incomes, you can transfer up to £1,260 of your allowance through the Marriage Allowance, saving up to £252 a year. Small adjustments like this can make a noticeable difference over time.

If you’re still working in later life, there’s some positive news. National Insurance (NI) rates have fallen again:

And if you’re over State Pension age, you don’t pay NI at all, even if you’re still earning.

These changes mean more take-home pay for those topping up their income through part-time work or consultancy.

If your savings or investments are growing thanks to higher interest rates or a strong market, you’ll need to watch your tax position carefully.

Dividend income now enjoys only a £500 tax-free allowance, down from £2,000 just a few years ago. Above that:

Meanwhile, the Personal Savings Allowance remains:

That means many people will start paying tax on savings interest for the first time.

Tip: Consider using ISAs, which shelter income and gains from tax. You can invest up to £20,000 per year across Cash, Stocks and Shares, or Innovative Finance ISAs. Couples can double up to £40,000 between them.

If you hold investments jointly, spreading assets between partners can also help make the most of available allowances.

The CGT allowance has been cut again, it’s now just £3,000, down from £12,300 two years ago. This means more people could face tax when selling shares, second homes, or other investments.

If you’re planning to sell investments, consider spreading disposals across tax years or using your spouse’s allowance to double your CGT exemption.

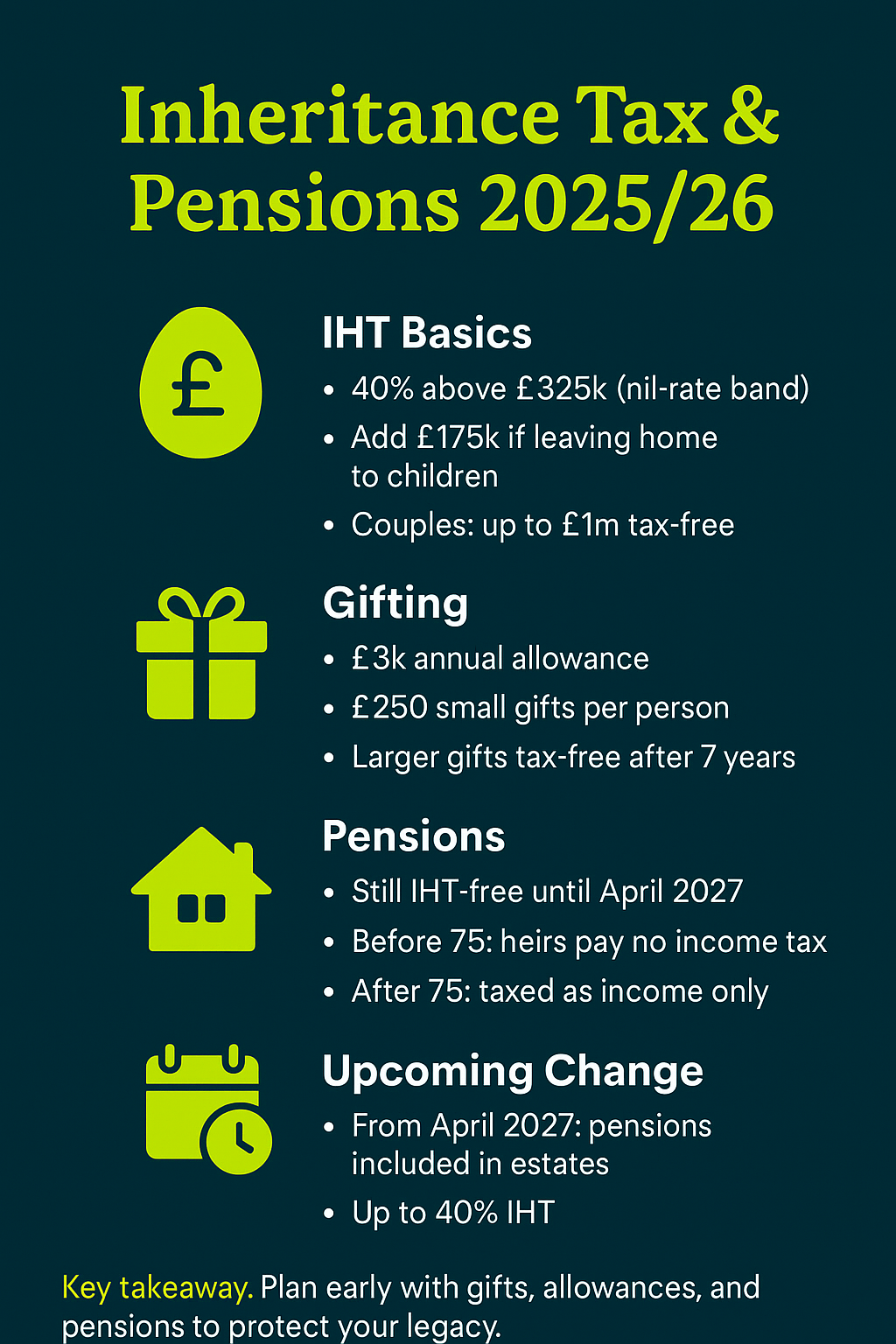

While rates haven’t changed, the freeze on thresholds means IHT is catching more estates than ever before. The main allowances are:

Together, a couple can pass on up to £1 million tax-free, provided their estate qualifies. But with property prices and investments rising, many families are edging closer to that limit.

Tip: Regular gifting can help reduce future IHT bills, and some gifts are immediately exempt. You can give away up to £3,000 per year (plus carry one unused year forward), make small gifts of £250 per person, or give wedding gifts up to certain limits. These small gestures can make a big difference over time.

Even though rates look stable on paper, inflation quietly pushes more people into higher bands, a phenomenon often called fiscal drag. For retirees on fixed incomes, that means you might pay more tax simply because your pension or savings interest has increased slightly.

This “stealth tax” effect is expected to raise billions for the Treasury in the coming years, so reviewing your tax position annually is essential. Simple actions like managing drawdowns from pensions, making use of ISAs, or planning gifts early can make your finances far more efficient.

Our team at Zomi Wealth helps clients build flexible strategies to manage income tax, reduce inheritance exposure, and ensure family wealth is passed on efficiently.

To make planning easier, we’ve created a comprehensive Inheritance Tax Planning Guide for 2025, designed specifically for retirees and pre-retirees.

👉 [Download your free Zomi Wealth Inheritance Tax Planning Guide] to explore your options in detail.

For more retirement planning insights, market updates, and tax-saving tips, follow Zomi Wealth on:

Stay informed and inspired as you plan your financial future.