Important Disclaimer:

This article is for information only and does not constitute financial advice. Pension and investment decisions are complex and depend on individual circumstances. Always seek guidance from an FCA regulated financial adviser before making decisions.

• Under Pension Freedoms, you can normally access your pension from age 55 (rising to 57 in 2028).

• You can usually take 25% of your pension tax free. This is known as pension tax free cash.

• The rest of your lump sum is taxed as income in the year you withdraw it, which may push you into a higher tax bracket.

• £50,000 can normally be taken tax free.

• The remaining £150,000 is subject to income tax.

1. Flexibility – You control how you use the money.

2. Debt repayment – Clearing a mortgage or loans before retirement reduces monthly outgoings.

3. Helping family – Many use lump sums for gifting or supporting children with property deposits.

4. Reinvestment opportunities – You may prefer to move money into ISAs, property, or other investments that suit your needs.

• 25% tax free: Known as the “pension commencement lump sum”.

• Balance taxable: Added to your income for that tax year.

• Pitfall: Taking too much in one go can move you into the higher (40%) or additional (45%) rate brackets.

• 20% tax on part of the withdrawal.

• 40% tax on the rest.

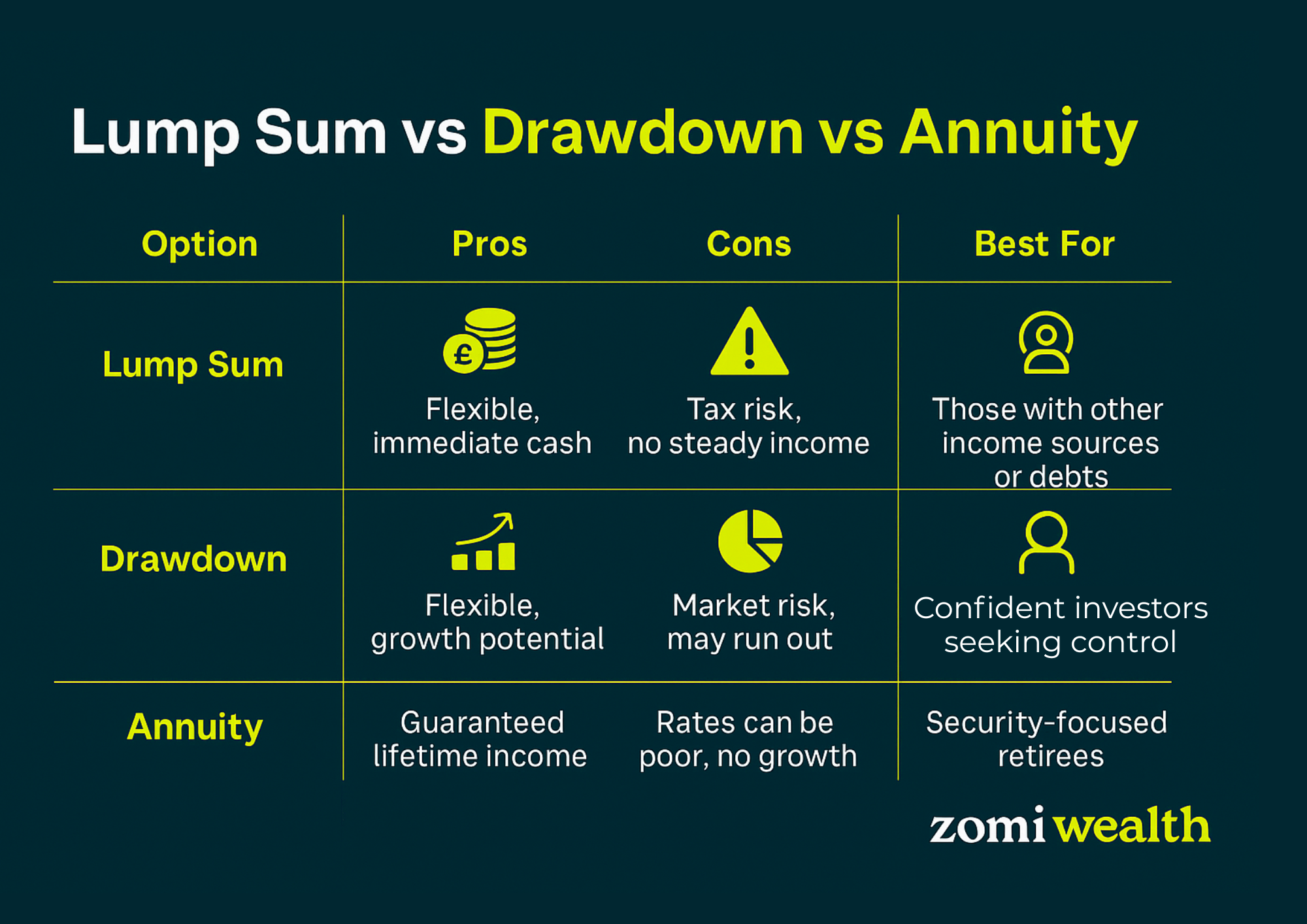

• Lump sum suits: those with other income sources, debts to clear, or family support goals.

• Regular income suits: those who rely on pensions as their main retirement income.

• Drawdown – leaving your pension invested and withdrawing as needed.

• Annuities – converting your pot into a guaranteed income for life.

• State pension – providing a safety net alongside private pensions.

• At the current inflation rate UK (around 4% in 2025), £100,000 could lose nearly half its purchasing power over 20 years.

• Tools like the “how much is money worth now calculator UK” help show how savings erode.

• According to UK inflation rate forecast data, inflation may remain above the 2% Bank of England target for several years.

• Flexi-access drawdown – flexible withdrawals, with money staying invested.

• Annuities – secure, guaranteed payments for life.

• Keeping funds invested – delaying withdrawals until needed.

Instagram: @ZomiWealth

LinkedIn: Zomi Wealth

X (formerly Twitter): @ZomiWealth

Facebook: Zomi Wealth

Subscribe to our newsletter for exclusive tips, expert advice, and the latest updates from Zomi Wealth—delivered straight to your inbox.

Know more about Zomi Wealth, how we invest, our plans and how to be a part of Zomi Wealth. Contact Us!