• Definition: Inflation is often described as the rate at which purchasing power declines.

• Everyday impact: If your weekly shop costs £100 today, with inflation it might cost £103 next year.

• Savings erosion: If your savings grow more slowly than prices, your real wealth falls.

• CPI (Consumer Prices Index): The main measure, tracking everyday goods and services.

• RPI (Retail Prices Index): Still used for some contracts, though less common.

• £1,000 in 2000 is worth around £1,750 today, showing the impact of 25 years of inflation.

1. Demand-pull inflation: When demand for goods and services exceeds supply, prices rise.

2. Cost-push inflation: When the costs of production (like wages or energy) rise, businesses pass them on to consumers.

3. Monetary policy factors: Low interest rates and quantitative easing can increase money supply, fuelling inflation.

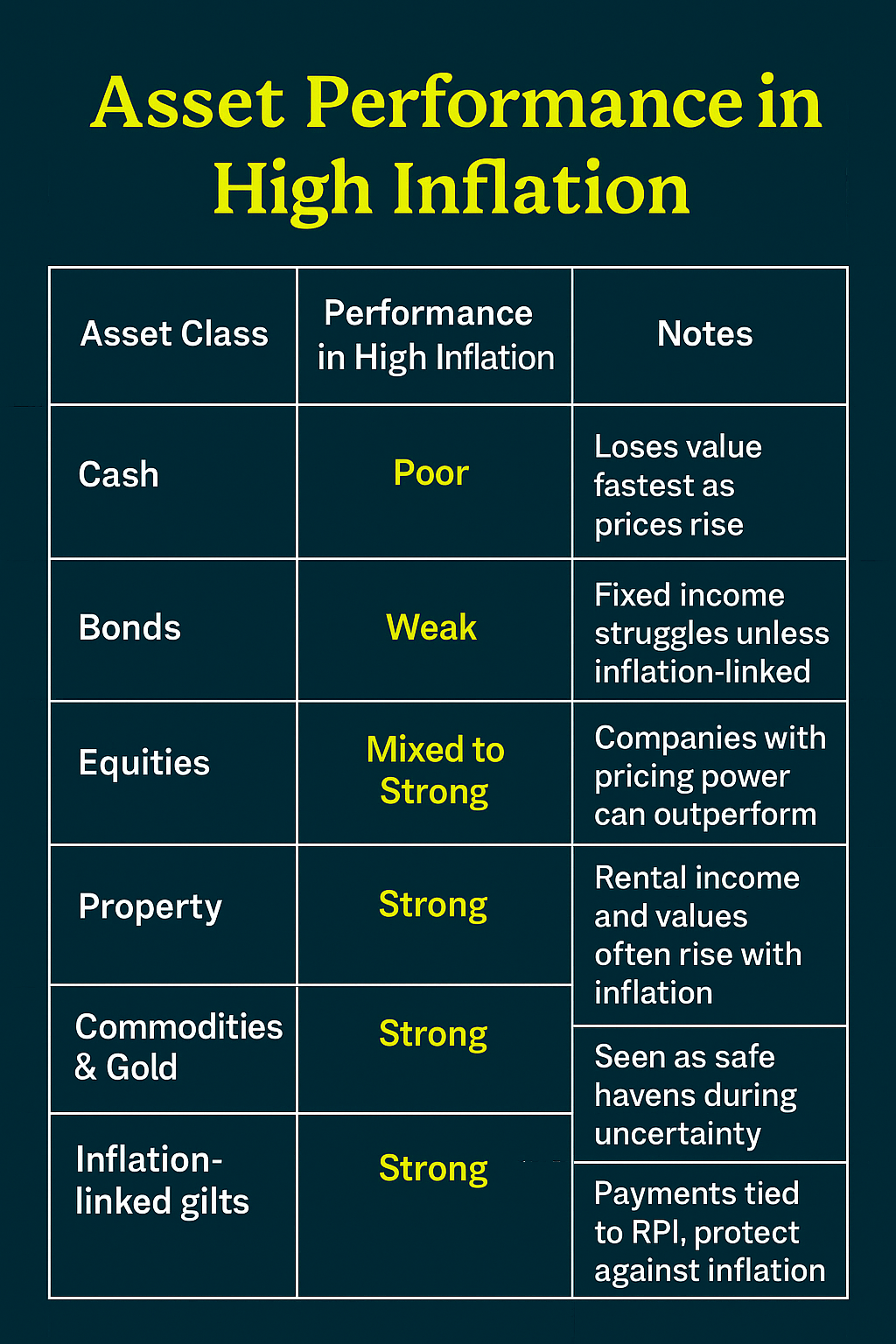

• Cash and fixed income: Cash loses value fastest. Traditional bonds also struggle, as fixed coupon payments buy less over time.

• Equities: Shares may outperform if companies can pass higher costs onto customers.

• Property: Bricks and mortar often keep pace with inflation, especially in the long term.

• Real assets and commodities: Gold, oil, and raw materials are classic hedges.

• Cash and bonds underperform.

• Volatility increases in equities.

• Equities – especially companies with pricing power.

• Property – rental income often rises with inflation.

• Inflation-linked gilts – government bonds tied to RPI.

• Commodities and gold – safe havens in uncertain times.

• 10% average annual return for equities

• 5% for bonds

• 3% for cash

• Global energy markets

• Supply chain disruptions

• Government fiscal policy

Instagram: @ZomiWealth

LinkedIn: Zomi Wealth

X (formerly Twitter): @ZomiWealth

Facebook: Zomi Wealth

Subscribe to our newsletter for exclusive tips, expert advice, and the latest updates from Zomi Wealth—delivered straight to your inbox.

Know more about Zomi Wealth, how we invest, our plans and how to be a part of Zomi Wealth. Contact Us!