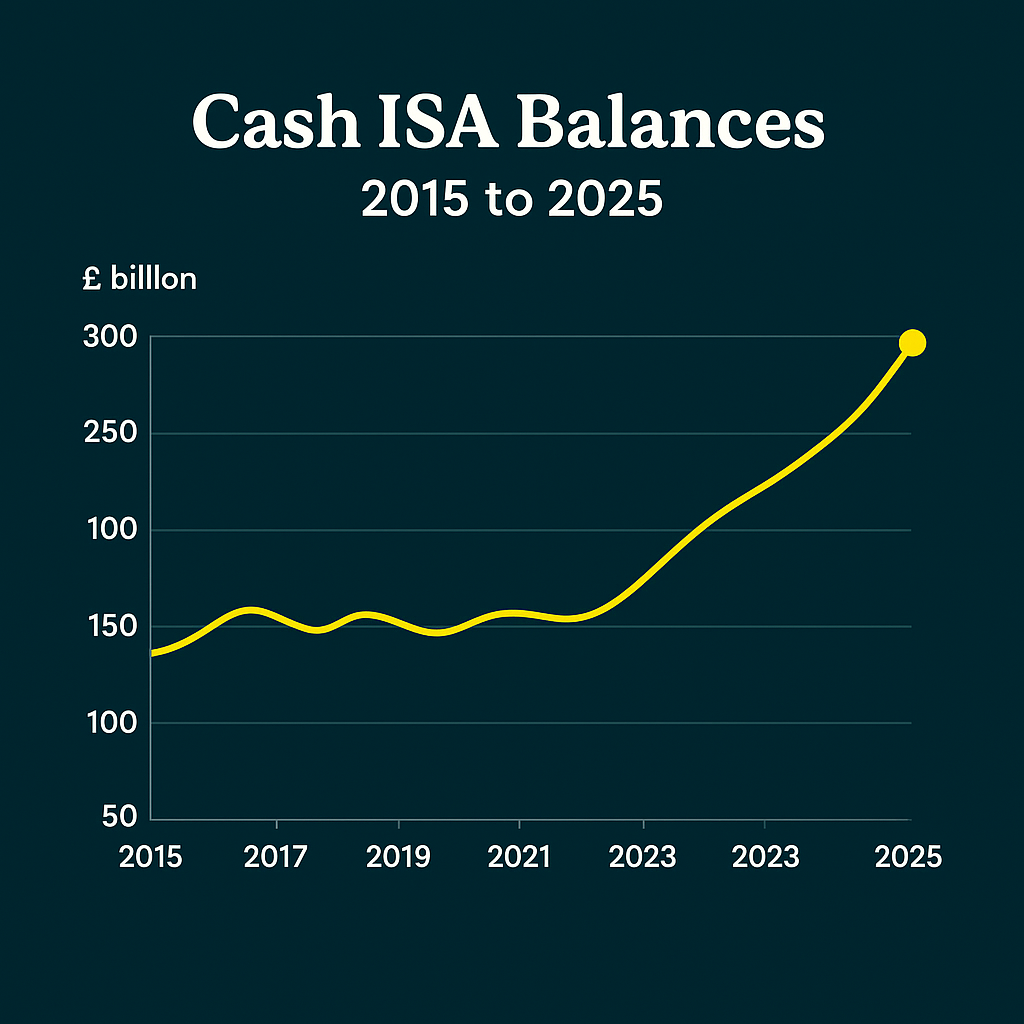

According to the latest figures from HMRC, the total amount held in Cash ISAs in the UK has now exceeded £294 billion – a record high. This landmark figure highlights a renewed focus among UK savers on tax-free, low-risk saving options amidst economic uncertainty and rising interest rates.

So, why does this number matter? For context, £294 billion spread across the adult UK population averages over £5,500 per person – suggesting that ISAs remain one of the nation’s go-to saving tools.

In this guide, we’ll explore:

Let’s dive into what the £294bn Cash ISA milestone really means for UK savers.

In your 20s, time is your biggest financial asset. Thanks to compounding returns, even small amounts saved early can grow significantly over decades. For example, saving just £200 a month from age 22 could lead to more than £150,000 by the time you are 60, assuming a modest 5% annual return.

ONS data shows the average UK adult in their 20s has around £3,000 in savings, far below the recommended emergency cushion. Starting early can help you:

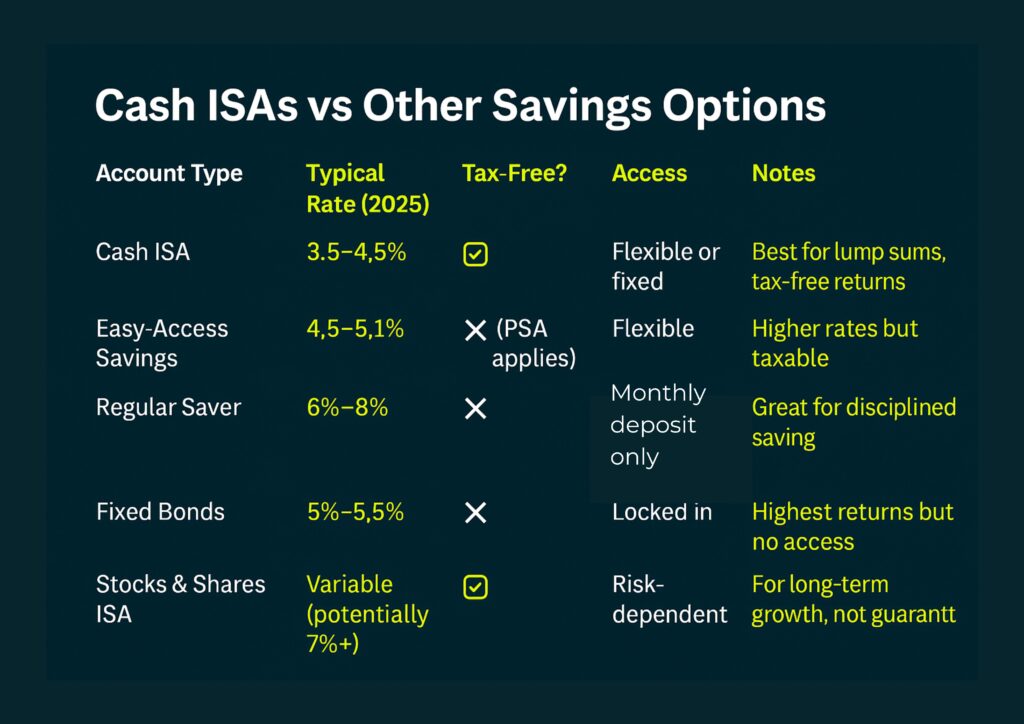

The Bank of England’s base rate hikes between 2023 and 2025 have directly boosted Cash ISA rates. With many ISAs now offering 3.5%–5% AER, savers are locking in better returns while protecting interest from tax.

The Personal Savings Allowance (PSA) allows up to £1,000 of interest tax-free for basic-rate taxpayers (£500 for higher-rate). But rising rates mean more savers are breaching this limit, making the tax-free status of ISAs more valuable.

“Once your interest income exceeds £1,000, every extra pound is taxed – making Cash ISAs a tax-efficient shield.”

Surplus savings from lockdown periods are now being “parked” in ISAs. In fact, a 2024 survey showed that 1 in 3 UK savers increased their ISA contributions in the past 12 months.

Paradoxically, high inflation is encouraging some households to build bigger cash buffers. Even if inflation erodes real value, the security of cash and FSCS protection (£85,000 per institution) is appealing in volatile times. Surplus savings from lockdown periods are now being “parked” in ISAs. In fact, a 2024 survey showed that 1 in 3 UK savers increased their ISA contributions in the past 12 months.

A glut of ISA deposits may make big banks less eager to compete on rates – especially if they no longer need new deposits. That said, smaller banks and challengers may continue offering top-tier ISA rates to attract customers.

“If your ISA rate is under 3%, you’re likely missing out. Shop around before your money quietly loses value.”

Even at 5% interest, your money loses ground if inflation is higher. Savers should look for high interest savings accounts or fixed-rate ISAs to reduce the erosion of purchasing power.

A reminder: you’re protected up to £85,000 per financial institution. With large sums in ISAs, some savers may want to split savings across banks or consider NS&I, which is 100% government-backed.

The £294bn total also reflects many Britons’ preference for cash over volatile stocks. While safer, there may be missed growth opportunities for long-term funds that could be invested.

Not all ISAs are created equal. Use comparison sites or best-buy tables to identify top-paying Cash ISAs.

“You can transfer your existing ISA to another provider with a better rate – all without losing your tax-free status.”

You can save up to £20,000 per tax year in ISAs. Using your full allowance means more interest shielded from tax. Even if other accounts offer slightly more, the tax advantage compounds over time.

If your ISA is maxed out or you want to build up savings monthly, consider regular saver accounts (some offering 7%+ on monthly deposits). These complement your ISA for new savings.

Even mainstream options like Nationwide’s Regular Saver (8%) or Santander’s 4% Easy Access ISA are competitive depending on your goals.

Cash ISAs are still ideal for larger lump sums and higher-rate taxpayers. But mixing in regular savers or fixed bonds may help you boost your overall returns.

Several banks offer 7% AER via regular saver accounts, including:

These accounts require a linked current account and monthly contributions – they are not lump sum accounts.

Check comparison tools regularly, as rates change frequently.

The Co-op Bank’s 7% Regular Saver pays 7% AER for Co-op current account holders.

ISA remains a smart first choice for most savers with a lump sum – especially higher earners.

With £294 billion now held in Cash ISAs, UK savers have sent a clear message – tax-free, secure savings remain a top priority.

As interest rates and inflation shift, it’s vital to:

Whether you’re building an emergency buffer or a future “freedom fund”, Cash ISAs remain a cornerstone of smart saving in the UK.