Gold has stolen the spotlight in 2025. For the first time ever, spot prices have crossed US$4,000 per ounce, marking a record high that reflects the global rush toward safe-haven assets. In sterling terms, gold is up over 40% this year, making it one of the best-performing asset classes.

Several forces are driving this rally. Persistent inflation, slowing economic growth, and renewed central bank buying have strengthened gold’s appeal. According to the World Gold Council, central banks increased their holdings by more than 1,000 tonnes in 2024, the second-highest figure on record. Meanwhile, volatility in bond and equity markets has led private investors to seek stability through tangible assets.

However, such momentum does not guarantee smooth sailing. Gold’s price is sensitive to interest rates, dollar strength, and investor sentiment. As some analysts warn, rapid rallies are often followed by sharp corrections; a reminder that timing matters as much as conviction.

Gold has always attracted attention during uncertain times. In 2025, several specific factors explain why more investors are considering adding it to their portfolios.

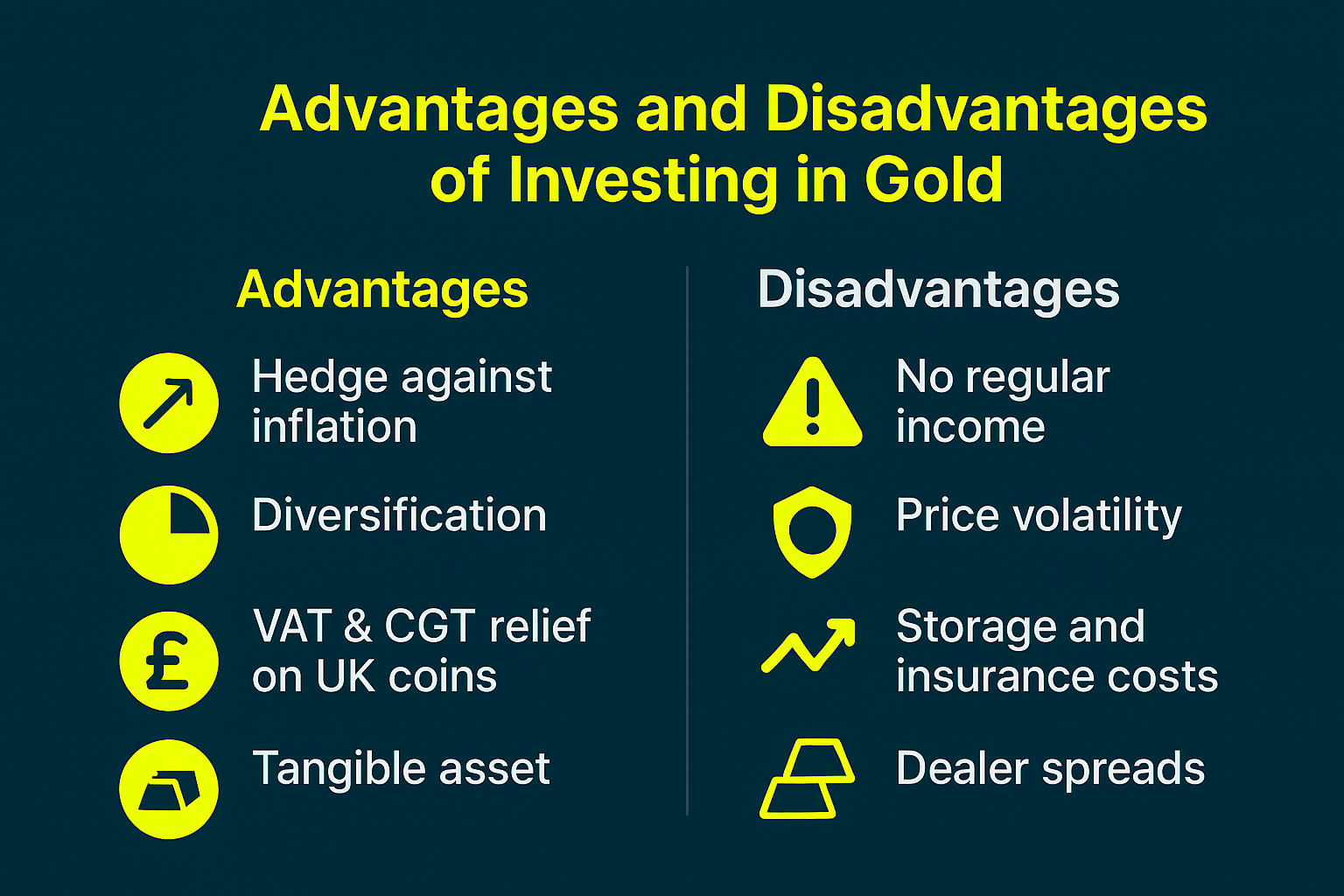

When inflation erodes the purchasing power of money, gold often retains its real value. Historically, gold prices tend to rise when currencies weaken or interest rates fall.

Gold behaves differently from shares or bonds. It tends to move independently of broader financial markets, making it a useful tool for reducing portfolio volatility. A modest gold allocation can smooth returns when equities falter.

Global institutions have continued to accumulate gold as a long-term reserve asset. This institutional demand helps underpin the metal’s value and provides additional market support during turbulent periods.

UK investors enjoy unique advantages. British gold coins, such as the Sovereign and Britannia, are exempt from Capital Gains Tax (CGT) and free from VAT. This makes them particularly efficient for long-term investors seeking to preserve wealth outside traditional markets.

Gold’s reputation as a safe haven doesn’t mean it is risk-free. Investors should understand the downsides before committing capital.

Unlike shares or bonds, gold does not pay dividends or interest. The only return comes from price appreciation, which can fluctuate over time.

Gold can experience sharp swings. Rising real interest rates or a stronger pound can reduce demand and pull prices lower, even in otherwise uncertain markets.

Physical gold requires safe storage, whether in a home safe or professional vault. These costs can erode returns, particularly on smaller holdings. Gold can experience sharp swings. Rising real interest rates or a stronger pound can reduce demand and pull prices lower, even in otherwise uncertain markets.

Buying and selling physical gold involves dealing spreads, the difference between dealer buy and sell prices, which may range from 3% to 10%.

ETFs and digital gold products depend on the reliability of the provider or custodian. Always check that a platform is FCA-regulated and that gold holdings are fully allocated and insured.

There are several routes to gain exposure to gold, each with unique benefits and considerations.

Popular investment coins include the Gold Sovereign and Britannia; both recognised globally and exempt from CGT. Bars can offer lower premiums per gram but are less flexible when selling small portions.

Exchange-Traded Funds (ETFs) and Exchange-Traded Commodities (ETCs) track the price of gold and trade on stock exchanges. They allow exposure without handling physical metal.

Several UK-regulated platforms offer fractional ownership of gold stored in professional vaults.

Investing in companies that produce gold provides leveraged exposure to the metal’s price movements.

Gold enjoys special tax treatment in the UK, but the rules vary depending on how you invest.

UK legal tender coins such as Sovereigns and Britannia’s are exempt from CGT, meaning profits are tax-free. Other gold investments, including bars or ETFs, are generally taxable if gains exceed your annual allowance.

Investment-grade gold – coins and bars of specified purity, is exempt from VAT. Collectable coins or jewellery may not qualify, so always confirm with your dealer.

You cannot hold physical gold directly in an ISA or SIPP, but gold ETFs or ETCs that meet HMRC rules can qualify.

Investors should keep purchase invoices and sale receipts for tax records. Always ensure transactions are made through reputable dealers who follow anti-money-laundering regulations.

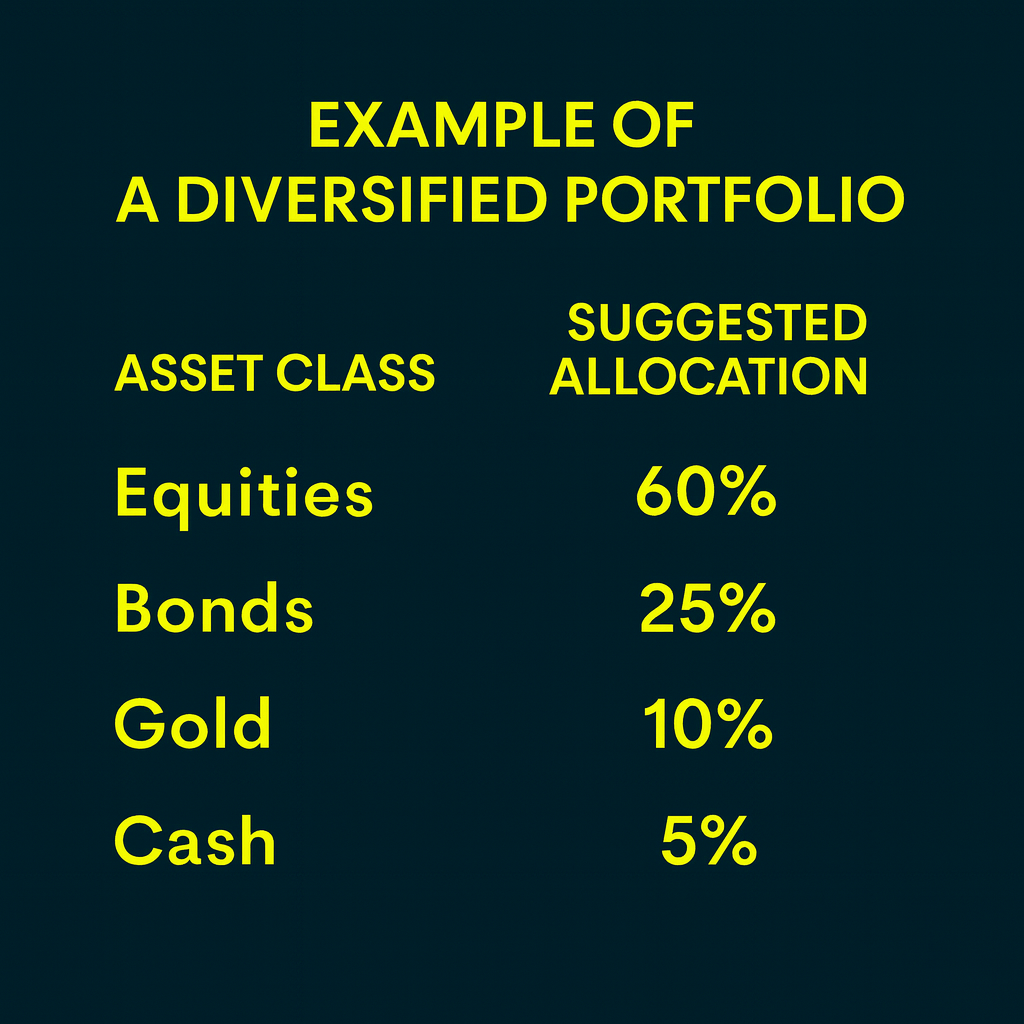

There is no one-size-fits-all answer, but most financial planners recommend a 3% to 10% allocation. The aim is not to maximise profit but to reduce portfolio risk.

For cautious investors, 5% in gold can act as a stabiliser during market downturns. For more aggressive investors, 10% may offer greater protection against inflation or currency depreciation.

Gold’s role is defensive, to preserve capital, not to replace growth assets.

Even with 2025’s record highs, gold can still have a place in long-term strategies. The key is not to chase price spikes.

Buying gold gradually, for instance monthly, helps average out price fluctuations. This approach, known as pound-cost averaging, reduces the risk of buying at peaks.

Gold tends to perform well when inflation is high, the pound weakens, or central banks signal lower interest rates. Monitoring these conditions can guide better entry points.

Periodically rebalance your portfolio. If gold’s share rises above your target due to price gains, consider trimming profits to maintain discipline.

Protecting your investment is as important as choosing it.

A trustworthy custodian and verifiable documentation are your best safeguards.

Gold is considered a safe-haven asset during uncertainty. While its price fluctuates, it tends to retain long-term value and offers protection against inflation.

Typically between 3% and 10%, depending on your risk tolerance and investment objectives.

Physical British coins such as Sovereigns and Britannia’s are CGT-exempt and VAT-free. Other forms, like ETFs or bars, may be taxable.

Coins offer tax advantages, bars provide efficiency for larger investors, and ETFs deliver convenience and liquidity. The best choice depends on your goals.

Historically, yes. Gold often maintains purchasing power during inflationary periods and acts as a hedge against currency depreciation.

Rather than timing the market, consider buying regularly through pound-cost averaging to smooth volatility.

Use accredited dealers, confirm authenticity, ensure your holdings, and verify that any digital or vaulted gold is fully allocated.

At Zomi Wealth, we view gold as a valuable component of a well-diversified portfolio when used thoughtfully. It can help safeguard wealth against inflation and uncertainty but should not replace growth assets like equities.