• Break down the different types of ISAs and pensions

• Compare their tax benefits, access rules, and contribution limits

• Offer example scenarios so you can decide which is right for you, or how to use both

• Cash ISA: Tax-free interest, ideal for lower-risk savings

• Stocks & Shares ISA: Tax-free growth and dividends on investments

• Lifetime ISA (LISA): Up to £4,000 a year plus a 25% government bonus for first home or retirement savings (age restrictions apply)

• Junior ISA: Long-term savings for under-18s

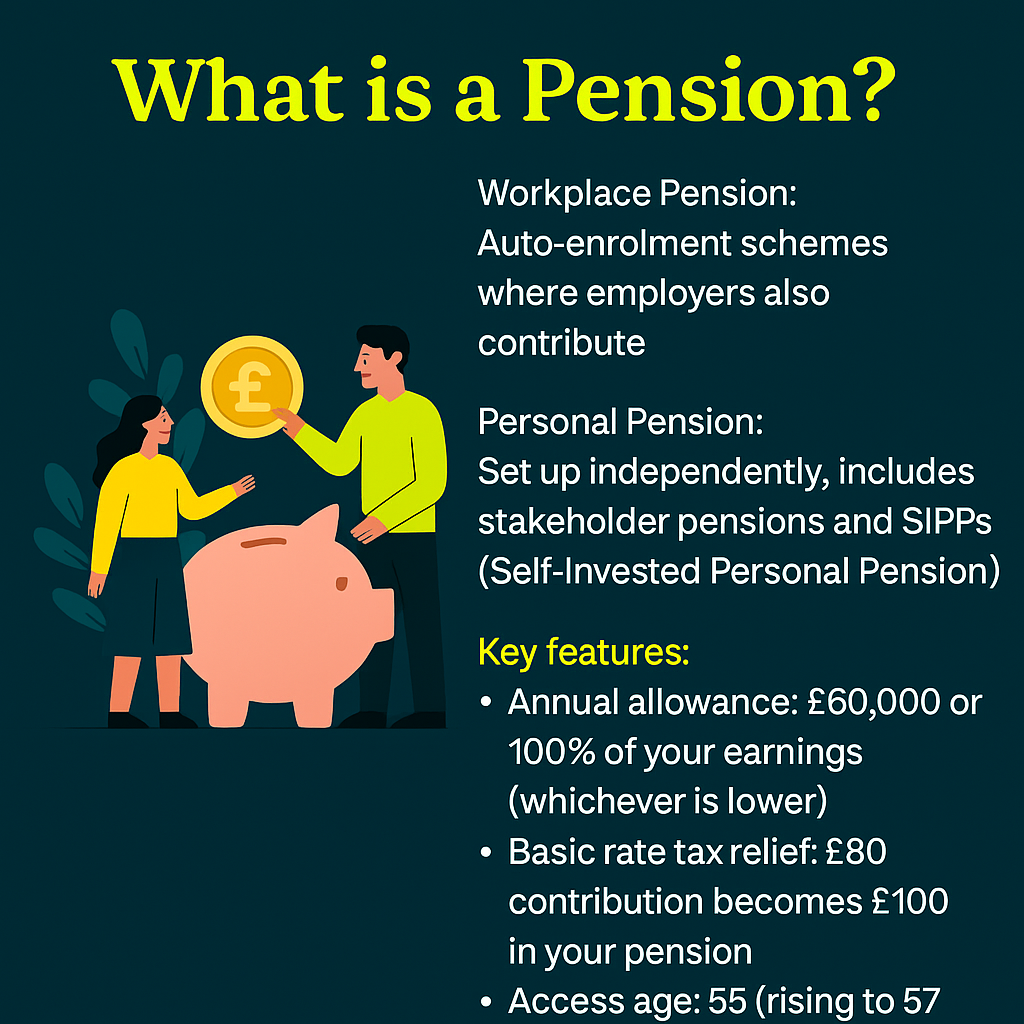

• Workplace Pension: Auto-enrolment schemes where employers also contribute

• Personal Pension: Set up independently, includes stakeholder pensions and SIPPs (Self-Invested Personal Pensions)

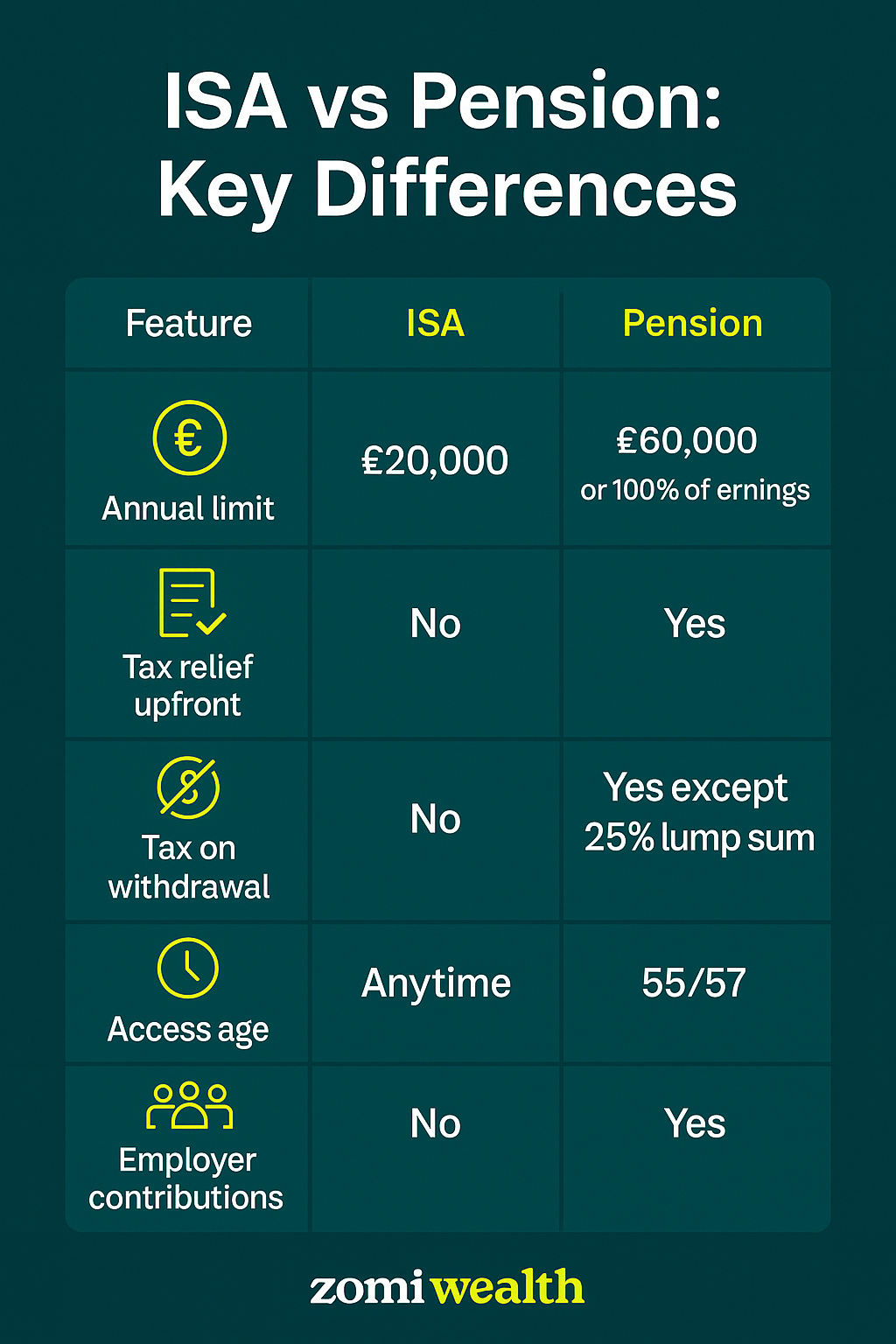

• Annual allowance: £60,000 or 100% of your earnings (whichever is lower)

• Basic rate tax relief: £80 contribution becomes £100 in your pension

• Access age: 55 (rising to 57 from 2028)

• 25% tax-free lump sum on withdrawal, rest taxed as income

• ISA: Withdraw anytime without penalty (except LISA early withdrawals)

• Pension: Locked until 55/57, suitable for long-term retirement savings

• Young basic-rate taxpayer: LISA plus workplace pension contributions

• High-rate taxpayer: Maximise pension for higher tax relief

• Self-employed: Balance ISA flexibility with pension retirement benefits

• First-time buyer: Use LISA for 25% bonus towards your deposit

• Need money before 55 → ISA

• Higher-rate taxpayer saving for retirement → Pension

• Want both flexibility and tax relief → Split between both

Subscribe to our newsletter for exclusive tips, expert advice, and the latest updates from Zomi Wealth—delivered straight to your inbox.

Know more about Zomi Wealth, how we invest, our plans and how to be a part of Zomi Wealth. Contact Us!