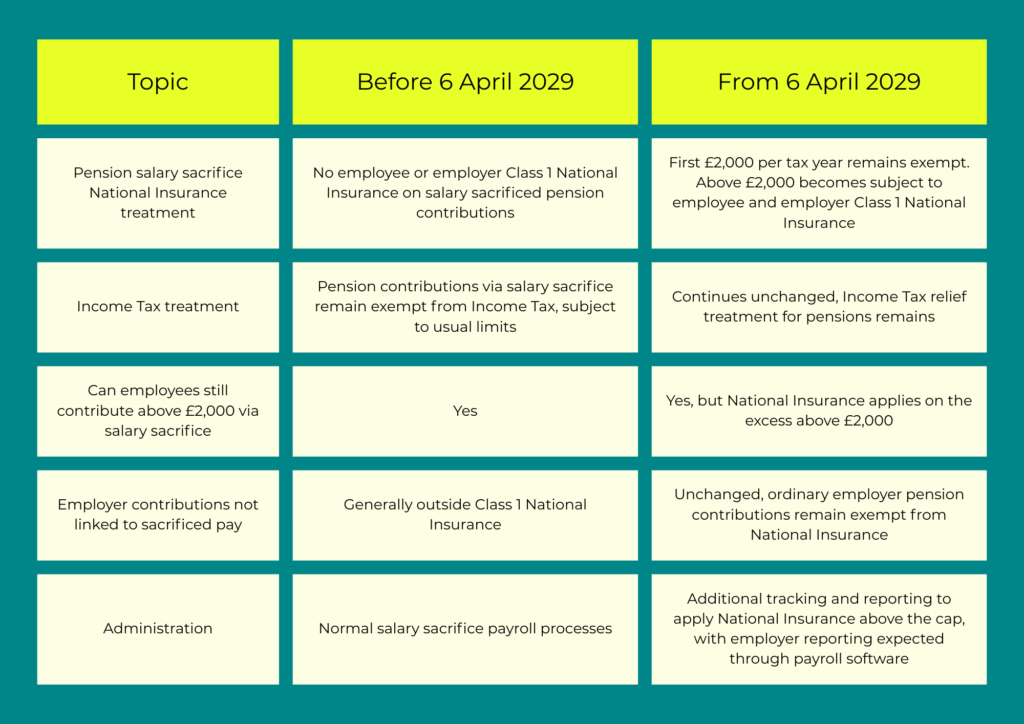

‣ Only the first £2,000 per tax year of employee pension contributions made via salary sacrifice will be exempt from National Insurance contributions

‣ Any salary sacrifice pension contributions above £2,000 per year will attract National Insurance in the usual way

‣ Income tax relief on pension contributions remains unchanged, subject to existing pension rules such as the annual allowance

Importantly, salary sacrifice itself is not being abolished. You will still be able to use it. The change relates specifically to the National Insurance treatment above the £2,000 threshold.

When reviewing your retirement planning strategy, it is sensible to consider:

‣ The level of your current pension contributions

‣ Whether you contribute more than £2,000 per year via salary sacrifice

‣ How pension savings fit into your broader financial goals

‣ The potential impact on take home pay in future

Financial planning works best when it is structured and aligned with your long term objectives rather than driven by short term headlines.

Instagram: @ZomiWealth

LinkedIn: Zomi Wealth

X (formerly Twitter): @ZomiWealth

Facebook: Zomi Wealth

Subscribe to our newsletter for exclusive tips, expert advice, and the latest updates from Zomi Wealth—delivered straight to your inbox.

“Zomi Wealth’’ is a trading name of Zomi Group Limited who are authorised and regulated by the Financial Conduct Authority (FCA), FRN 149309. Past performance is not indicative of future returns. An investor may get back less than the amount invested. Information on past performance, where given, is not necessarily a guide to future performance. The capital value of units in the fund can fluctuate and the price of units can go down as well as up and is not guaranteed. The opinions and views expressed in this newsletter may not necessarily reflect the views of Zomi Group l Limited or its affiliates. The information provided in this newsletter is for informational purposes only and does not constitute a recommendation from any Zomi Group Limited entity to the recipient. Zomi Group Limited is not providing any financial, economic, legal, investment, accounting, or tax advice through this newsletter or to its recipient. Certain information contained in this newsletter constitutes “forward-looking statements,” and there is no guarantee that these results will be achieved. Zomi Group Limited has no obligation to provide any updates or changes to the information in this newsletter. Zomi Group Limited always recommends that the recipient take independent financial advice. Alternative investments often engage in leverage and other investment practices that are extremely speculative and involve a high degree of risk. Such practices may increase the volatility of performance and the risk of investment loss, including the loss of the entire amount that is invested. These investments are usually highly illiquid and generally not transferable without the content of the sponsor.

Investing in cryptocurrency is highly speculative and involves significant risk to capital, as its value is extremely volatile and can fluctuate widely in short periods. It is not regulated by the Financial Conduct Authority, meaning investors may not have access to financial protections, including the Financial Services Compensation Scheme (FSCS) or the Financial Ombudsman Service. There is also a risk of loss from fraud, cybersecurity breaches, or operational failures within cryptocurrency platforms. Investors should carefully consider whether they can afford to lose the entirety of their investment.

Know more about Zomi Wealth, how we invest, our plans and how to be a part of Zomi Wealth. Contact Us!