According to the FCA Financial Lives Survey, over 40% of UK adults aged 20–29 have less than £1,000 in savings, and many have none at all. This lack of financial safety net can make it harder to cope with emergencies or take advantage of future opportunities.

As part of UK Savings Week 2025, we are shining a light on the top three savings mistakes people make in their 20s, and, most importantly, how to avoid them. Whether you are finishing university, starting your first job, or navigating early career changes, building smart savings habits now will set you up for a secure future.

In your 20s, time is your biggest financial asset. Thanks to compounding returns, even small amounts saved early can grow significantly over decades. For example, saving just £200 a month from age 22 could lead to more than £150,000 by the time you are 60, assuming a modest 5% annual return.

ONS data shows the average UK adult in their 20s has around £3,000 in savings, far below the recommended emergency cushion. Starting early can help you:

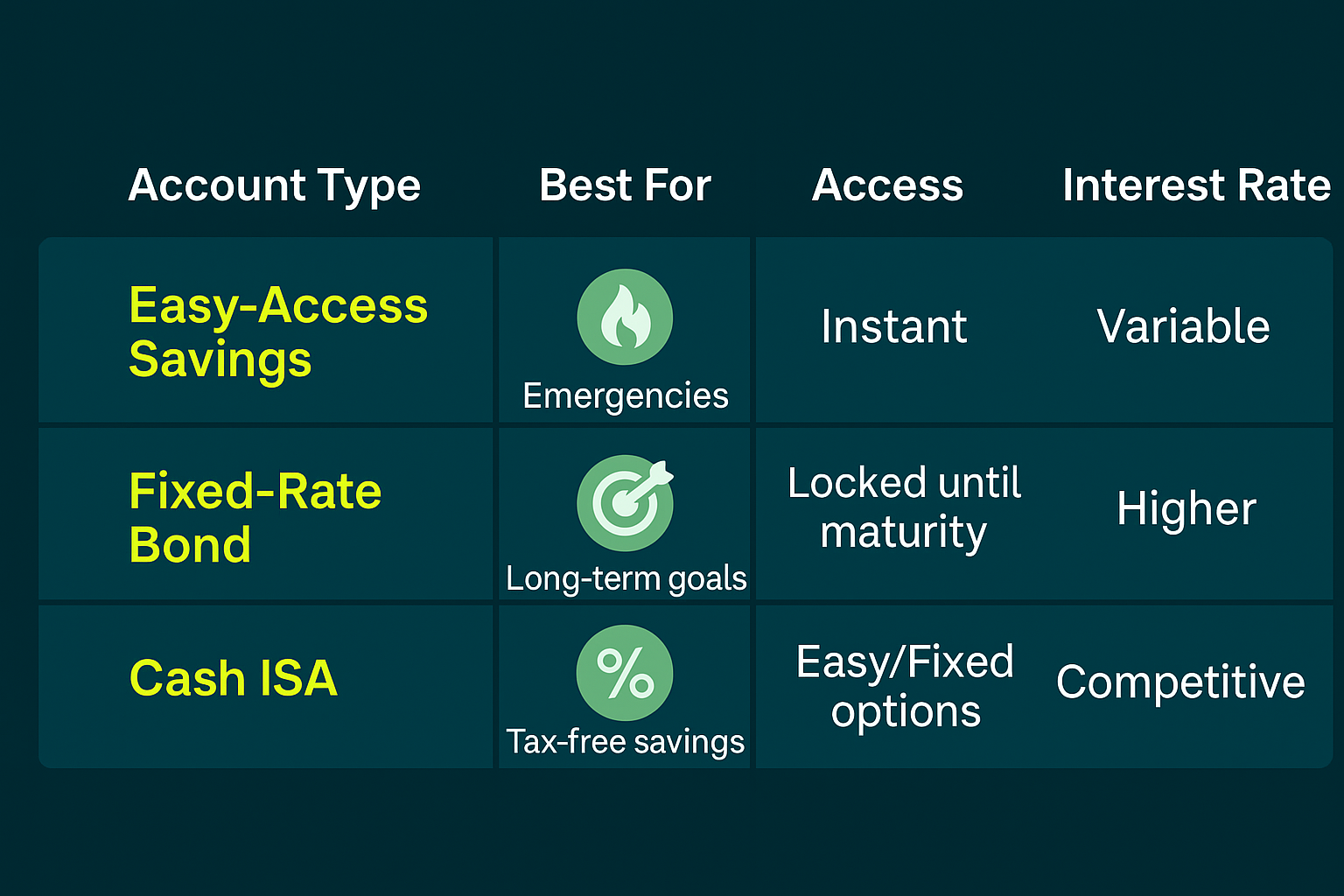

Without an emergency fund, unexpected costs, like car repairs or medical expenses , can force you into debt. An emergency fund should ideally cover three to six months of living expenses and be kept in an easy-access, high-interest savings account.

Many young adults overlook Cash ISAs and high-interest savings accounts that protect your money while paying better rates.Ideal for those who want:

Pro Tip: Open a Cash ISA to protect your savings from tax while keeping them accessible.

High savings rates grab attention, but moving money between accounts too often can backfire if you lose access or face withdrawal penalties.

When choosing a savings account, consider:

ISAs are one of the most powerful savings tools in the UK, offering tax-free interest and annual allowances of up to £20,000. For long-term growth, Stocks & Shares ISAs and General Investment Accounts (GIAs) can help your money work harder.

Even with a modest income, you can save effectively using the 50/20/30 budgeting rule:

Automating savings each payday removes the temptation to spend and ensures consistent progress.

It is a budgeting method that allocates 50% of income to needs, 20% to savings, and 30% to wants.

Automating savings into a high-interest or tax-free account is one of the best methods.It lets you keep your pension invested and withdraw funds as needed, offering flexibility but with risk.

Yes, especially if started early. Consistent savings add up significantly over time.Annuity is generally safer as it offers guaranteed income. Drawdown can fluctuate based on market performance.

According to ONS data, the average is around £50,000 – £70,000, though this varies widely.Yes. Some retirees choose a blended strateg, using part of their pension for an annuity and the rest in drawdown.

The sooner you start saving, the easier it is to achieve financial security. Regularly review your accounts, avoid the common mistakes above, and make use of tax-free savings tools.

Note to Reader: This content is for general information only and does not constitute financial advice. Please speak to a qualified financial adviser before making any financial decisions. Past performance is not a reliable indicator of future results. Investments can go down as well as up.